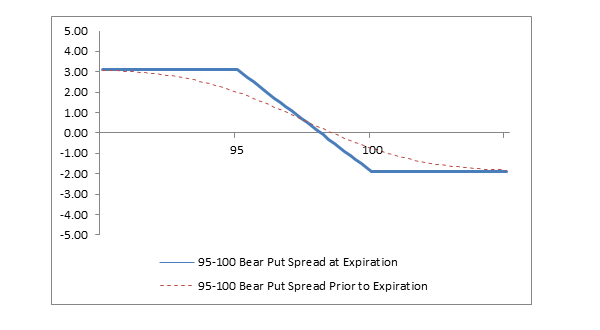

Bear Put Spread Payoff

For example a bull spread constructed from calls eg long a 50 call short a 60 call combined with a bear spread constructed from puts eg long a 60 put short a 50 put has a constant payoff of the. However there are a few differences in terms of strategy execution and strike selection.

An average price put is considered an exotic option since the payoff depends on the average price of the underlying over a period of time as opposed to a straight put the value.

. Here is an example of constructing a bear spread which is a combination of 2 puts or 2 calls put is the default. The stock market contracted so much that it would take until 1954 to fully regain its pre-crash value. The Bear Call spread.

Similar to the Bear Put Spread the Bear Call Spread is a two leg option strategy invoked when the view on the market is moderately bearish. The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads. Le put agit donc comme une assurance doù le nom de prime donné à son prix.

Conversely if the average price of the underlying asset is below the strike price of such a put the payoff to the option buyer is positive and is the difference between the strike price and the average price. Although buyers of a protective. The credit received is the maximum potential profit for the trade.

Bear with us phrase. Here we are short a put at 1950 and long a put at 2050. The relationships is linear and the slope depends on position size.

À lopposé le spéculateur qui désire vendre un put estime que le prix du sous-jacent ne va pas baisser sous le prix dexercice à lhorizon de la date. A butterfly spread is a neutral option strategy combining bull and bear spreads. Butterfly spreads use four option contracts with the same expiration but three different strike.

Like the case of a single option the instance methods are vectorized so we can compute payoff and profit across a vector or grid. Loption de vente permet également pour son acheteur de spéculer sur la baisse du sous-jacent en limitant le risque puisque seule la prime est engagée. The stock market crash of 1929 put an end to the Roaring 20s and started the Great Depression.

What does bear with us expression mean. For example if a 5 wide bull call. A protective option constructed with a put to cover shares of stock that an investor owns is called a protective put or married put while.

Additionally it can lead to an arbitrage. In this case with 1 contract representing 100 shares the profit increases by 100 for every 1 decrease in underlying price. A high delta of expiring in the money then the premium you are receiving for that spread may not be worth the higher risk.

Above the strike the line is upward sloping as the call options payoff is rising in proportion with the underlying price. You can use the delta filter in this case any. Similar to the Bull Call Spread the Bear Put Spread is quite easy to implement.

CDS can be thought of as a put option on a corporate bond. Definitions by the largest Idiom Dictionary. Because long options are purchased for protection the maximum risk is limited to the width of the spread minus the credit received.

Definitions by the largest Idiom Dictionary. The Bear Call Spread is similar to the Bear Put Spread in terms of the payoff structure. The debit paid is the maximum potential loss for the trade.

72 Strategy notes. The first bearish strategy we will look into is the Bear Put Spread which as you may have guessed is the equivalent of the Bull Call Spread. From pyfinance import options as op.

On the surface Fallout 76 is another dose of Bethesdas tried-and-true open-world RPG formula on a larger-than-ever map thats begging to be explored. In a credit put spread if you are selling a strike that has a high probability ie. And a protective call will have the same net payoff as merely buying a put option.

A protective option could be used instead of a stop-loss order to limit losses on a stock position especially in a fast-moving market. Because a short option is sold to reduce the trades cost basis the maximum profit potential is limited to the spread width minus the debit paid. As you can see in the graph the options strike price 4500 is the key point which divides the payoff function in two parts.

As you can see in the diagram a long put options payoff is in the positive territory on the left side of the chart and the total profit increases as the underlying price goes down. In options trading a box spread is a combination of positions that has a certain ie riskless payoff considered to be simply delta neutral interest rate position. For example if a 5 wide.

A dealer poll would then be conducted. Bull put spreads collect a credit when entered. The bull put credit spread payoff diagram clearly outlines the defined risk and reward of credit spreads.

For example if. Definition of bear with us in the Idioms Dictionary. What does bear with us expression mean.

One would implement a bear put spread when the market outlook is moderately bearish ie you expect. Protection buyer is protected from losses incurred by a decline in the value of the bond as a result of a credit event. This investment strategy provides for minimal risk.

Below the strike the payoff chart is constant and negative the trade is a loss. A dual option position involving a bull and bear spread with identical expiry dates. Example of Cash Settlement The protection buyer in a 5000000 USD CDS upon the reference entitys filing for bankruptcy protection would notify the protection seller.

As a trader maybe you dont want anything that has over a 75 chance of expiring in the money because you view that as too risky. Bull call spreads require a debit when entered.

Trade Bear Put Spread Option Strategy Explained Options Futures Derivatives Commodity Trading

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

No comments for "Bear Put Spread Payoff"

Post a Comment